Ottawa announced the loan fund last May as a way to help Black business owners who require capital, which has been a long-standing barrier for some in the community. Entrepreneurs can apply for loans of between $25,000 and $250,000, with an interest rate of between 6 per cent and 8 per cent. Many Black business owners were enthusiastic about the program when it launched. Thousands of applications poured in, which quickly overwhelmed the Federation of African Canadian Economics (FACE), a coalition of Black business groups that had been set up to administer the loan fund. The money for the fund comes from the federal government and the Business Development Bank of Canada. BDC has final approval of the loans.

Since May 31, the fund has received 16,000 applications. According to data from the government, FACE and BDC, 935 of those applications have been reviewed, 142 received initial acceptance from FACE and 104 received final approval from BDC. Nineteen loans are still under review by BDC. A total value of $14.7-million in loans has been approved by FACE, with $8.6-million paid out so far. The fund’s budget is $160-million. FACE and the government blamed the low number of approvals on missing paperwork. FACE said it considered 14,000 files to be incomplete. But Black entrepreneurs who have spoken to The Globe and Mail say they have submitted what was asked of them and have gone months without being able to reach anyone at FACE about the status of their applications.

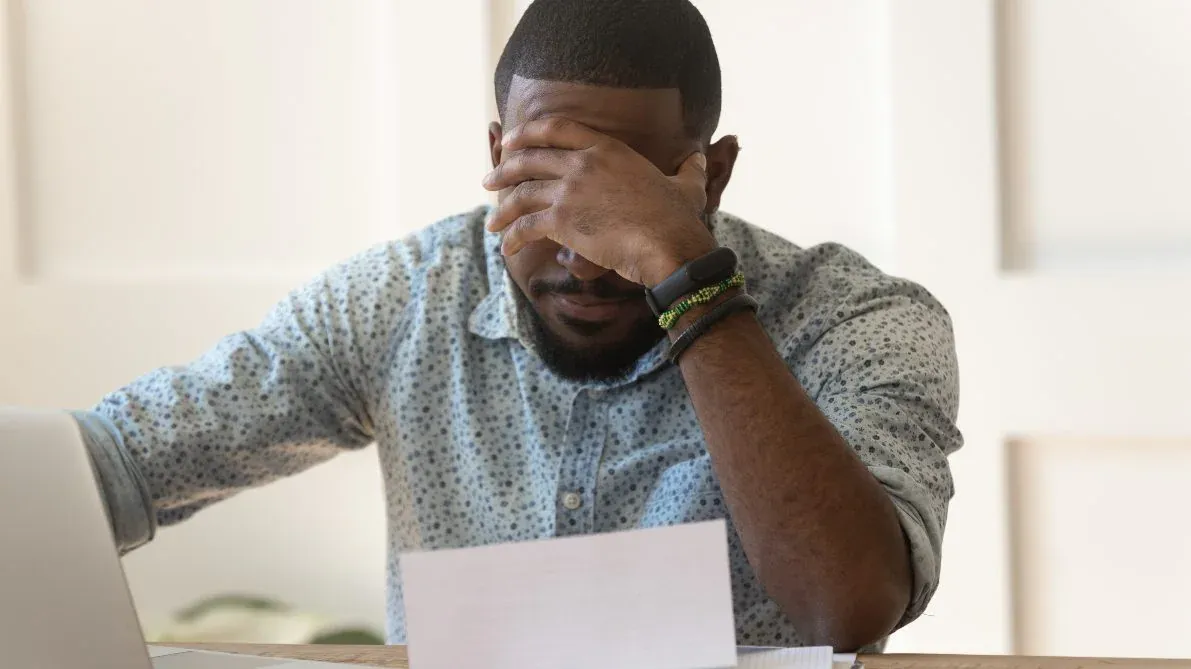

Sheriff Ganiyu, who runs the Titi African Foods grocery store in Richmond Hill, Ont., and produces a line of Zobo drinks, applied for a loan shortly after the program was announced last year. He said his initial contact was positive: He spoke with a loan officer, submitted the requested paperwork and was given the impression that he would qualify for a $100,000 loan. He went ahead and bought two shipping containers worth of product for his business. He said he had to max out four credit cards to make the purchase but expected the money from the loan to arrive quickly and cover the expense.

Ten months later, Mr. Ganiyu said his application still hasn’t been processed. He is now carrying debt and waiting to purchase critical equipment for his business, such as new freezers for meat. He said he recently managed to finally get his loan officer on the phone again and he was told there was no time frame for deciding his application. “How can a loan application have no time frame?” Mr. Ganiyu said. “It’s not personal money, it’s government money, for Black people. … You are supposed to make our lives easier. You made it even more miserable.”